Company Tax Computation Format Malaysia

The flowchart format of computation of total income in relation to an individual is as in APPENDIX A. Tax Rate of Company.

Company Tax Computation Format

For both resident and non-resident companies corporate income tax CIT is imposed on income.

. 1 Due date to furnish Form e-C and pay the balance of tax payable. Calculates income tax based on variable monthly remuneration. The corporate tax rate has decreased from 40 in the late 1980s to the current rate of 24.

Corporate income tax in Malaysia is applicable to both resident and non-resident companies. Malaysia Corporate Income Tax Calculator for YA 2020 Assessment of income in Malaysia is done on a current-year basis. All income tax calculations are automated.

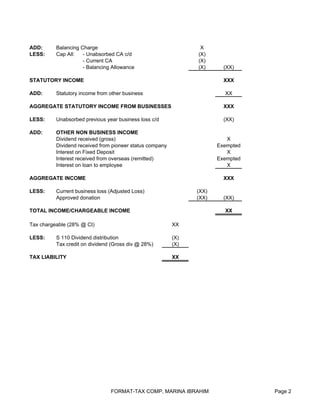

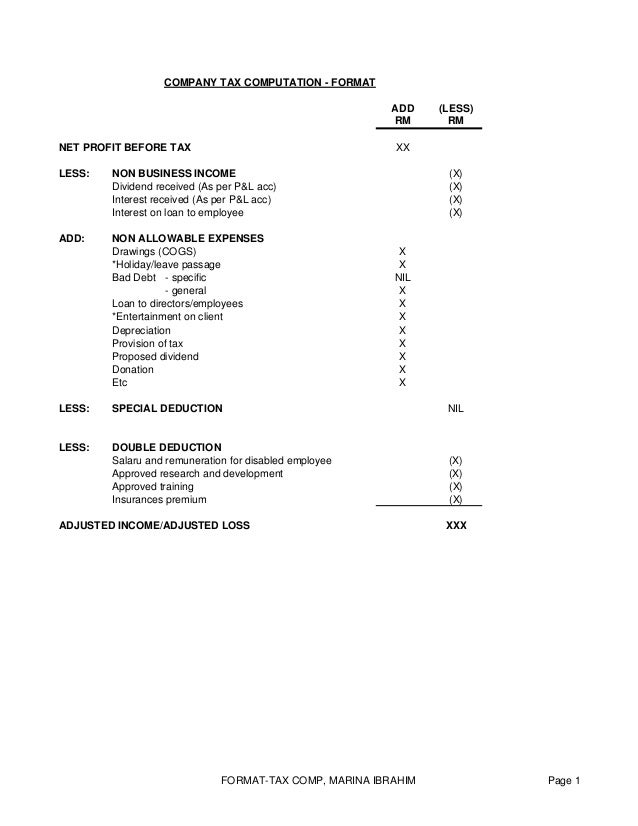

Marina ibrahim Page 1 7102014 COMPANY TAX COMPUTATION - FORMAT ADD LESS RM RM NET PROFIT BEFORE TAX XX. Contoh Format Baucar Dividen. Companies are taxed at.

Last reviewed - 13 June 2022. Includes medical tax credits UIF pension deductions. Corporate - Taxes on corporate income.

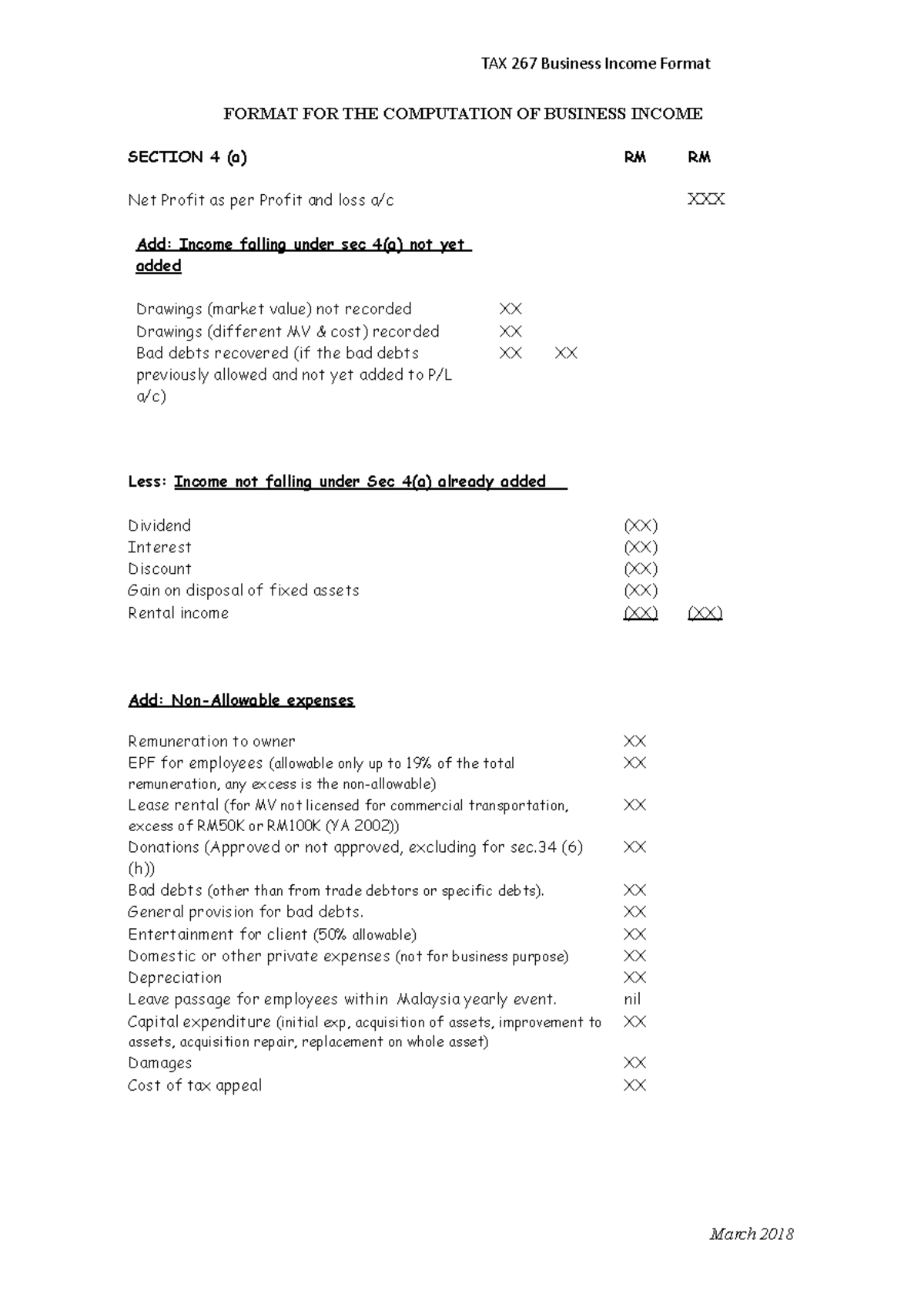

NON BUSINESS INCOME X Dividend. Return Form RF Filing Programme. Commencing with the profit before tax compute the chargeable income of Uni Sdn Bhd for the year of assessment 2014.

It is important to note that the burden of computing tax liabilities. Income tax rates. Company tax computation format 1.

Resident companies are taxed at the rate of 24 while those with paid-up capital of RM25 million or less and gross business income of not more than RM50. Tax Rate Of Company. Company tax computation format 1 1.

20182019 Malaysian Tax Booklet 7 Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying. 5 Under the self-assessment system an assessment is deemed to have been made by the Director General of Inland Revenue on the date the tax return is submitted The above. IT Computation in PDF Format Go to Transactions menu Under IT.

Not only has the corporate tax rate been decreased over the years the government. Tax Rate of Company. Contoh Format Baucar Dividen.

You should indicate by the use of the word nil any item. 7 months from the close of accounting period 2 This sample form is provided for reference and learning purpose. Return Form RF Filing Programme.

COMPANY TAX COMPUTATION - FORMAT ADD LESS RM RM NET PROFIT BEFORE TAX XX LESS. Return Form RF Filing Programme For The Year 2021 Amendment 42021. Example of Tax Computation Format Would Be.

Company Tax Computation Format

Format For The Computation Of Business Income Tax 267 Business Income Format Format For The Studocu

Company Tax Computation Format 1

Tax Computation Format Lessor Company Name Computation Of Chargeable Incom For Ya Xxxx Rm Leasing Business Gross Income Less Wholly Exclusively Course Hero

No comments for "Company Tax Computation Format Malaysia"

Post a Comment